Topfeel vs Fast-Fashion Makers: Which Makeup Bags Last Longer

Walk into any beauty store or scroll through an online marketplace and you’ll see the same thing: rows of pretty cosmetic pouches in every color and shape. Many of them come from fast-fashion accessory makers-factories that also churn out belts, handbags, and wallets for high-street brands. On photos, their makeup bags look very similar to what a specialist factory produces.

But once those bags go through six months of real use-pressed into carry-ons, dropped on bathroom counters, stained with foundation-the differences start to show.

This article takes a close, practical look at fast-fashion accessory suppliers vs. a beauty-focused manufacturer like Topfeel, and why the gap in long-term performance is bigger than it appears in catalog pictures.

What Fast-Fashion Accessory Makers Are Optimised For

Most fast-fashion accessory makers are built around one main idea:

follow trends fast, ship fast, and move on to the next season.

Their strengths usually include:

- Large production lines for handbags, wallets, card holders, small pouches

- Strong price negotiation on common materials like basic PU and polyester

- Fast sampling for “photo-ready” prototypes that meet a seasonal theme

When they add a cosmetic pouch to a collection, it’s normally:

- An add-on to match a bag collection

- Designed to look good as a set, not to be opened and closed daily for years

- Treated as a fashion item, not a work tool for someone’s routine

For brands that just need a low-cost, short-lived promo, this setup can be enough. The problem appears when a makeup bag is meant to be:

- Used every day

- Tied to a core product line

- Reviewed online and associated directly with the brand’s quality

That’s where structure, stitching, lining and zipper choice matter a lot more.

Common Pain Points with Fast-Fashion Makeup Bags

Buyers who’ve worked with general accessory factories often report similar issues after bulk orders start hitting the market:

Thin materials that don’t age well

- Very light PU that creases permanently and peels at corners

- Shiny polyester that snags easily

- PVC that turns cloudy or stiff in colder climates

Simplified construction

- Single main cavity, no real compartments

- Weak reinforcement at zipper ends and bottom corners

- Lining that sags or twists after a few weeks of use

Zipper problems

- Rails that feel rough from day one

- Sliders that deform under stress

- Corners that jam because the pattern wasn’t tailored for cosmetics

Shelf-first, user-second design

- Looks good standing on a display shelf

- Less thought given to what happens when you put in palettes, brushes, and bottles day after day

- None of this is surprising. Their core business is fashion turnover, not long-term beauty storage.

How a Beauty-Focused Manufacturer Like Topfeel Starts the Design

A specialist factory approaches cosmetic bags from the opposite direction:

it starts with what goes inside the bag, not just what will appear in photos.

Topfeel is a good example of this approach. The company is focused on designing and manufacturing cosmetic bags and beauty-related pouches, not generic accessories. It works with more than 30 different materials-including leather, mesh, cotton, velvet, quilted fabrics, canvas, PVC, and recycled textiles-and builds everything from cosmetic cases and toiletry bags to drawstring pouches, clutches, and travel makeup organizers.

Instead of only checking the Pantone number and logo size, the development process looks at:

Which products the end user needs to carry (lipsticks, foundation, brushes, skincare, tools)

Whether the bag will live mainly in a bathroom, handbag, suitcase, or retail gift box

How often it will be opened, wiped, and repacked

That information guides decisions on:

- Fabric weight and backing

- Lining type (wipeable, darker shade, or more tactile)

- Position and type of compartments (mesh pockets, brush holders, clear windows)

- Zipper size, puller type, and reinforcement points

The result is a pouch that may look simple from the outside but feels very different after six months of daily opening and closing.

Fast-Fashion vs Topfeel Makeup Bags

A simplified comparison many buyers recognise:

| Aspect | Fast-Fashion Accessory Makers | Beauty-Focused Manufacturer (e.g. Topfeel) |

|---|---|---|

| Main Product Focus | Handbags, belts, wallets, seasonal accessories | Cosmetic bags, toiletry bags, beauty travel kits |

| Design Priority | Visual match with clothing/handbag collections | Daily usability with real makeup & skincare |

| Material Choices | Common PU, basic polyester, standard PVC | 30+ materials incl. quilted PU, mesh, recycled, PVC |

| Interior Structure | One cavity, maybe a slip pocket | Compartments, brush slots, clear or mesh sections |

| Quality Control | Checks for appearance & basic stitching | Checks focused on zippers, lining tension, seams |

| Expected Lifespan | One fashion season | Multiple seasons of everyday use |

From a distance, both bags might share similar shapes and colors. In hand-and especially over time-the differences become obvious.

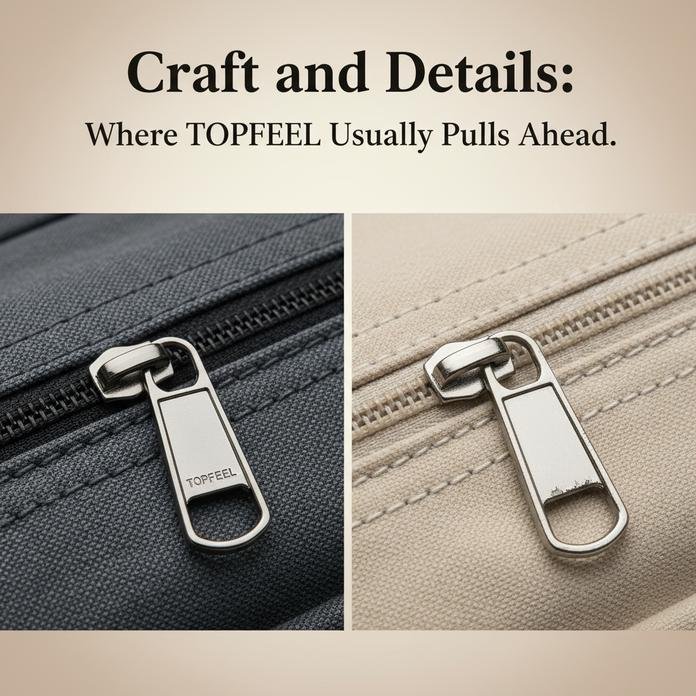

Craft and Details: Where Topfeel Usually Pulls Ahead

When you look closely at how a makeup bag is put together, a few things stand out:

Stitching

Fast-fashion pouches often have long stitch lengths and minimal bar-tacks to save time. Topfeel tends to use tighter, cleaner stitching on visible edges and reinforce stress points like zipper ends or handle attachments.

Lining and edge finishing

A lot of generic pouches use very light, loose lining that scrunches around products. Topfeel usually opts for denser, more stable linings, often in darker tones to hide minor stains, and takes care with binding on interior seams so edges don’t fray.

Zippers and hardware

Zippers are one of the first parts to fail in a makeup bag. Topfeel spends more attention here: smoother coil zips, properly aligned corners, and pullers that match the brand’s style instead of generic hardware thrown on at the last minute.

These touches don’t necessarily jump out on a product page, but they decide whether a bag feels “cheap” or “kept” after long-term use.

When a Fast-Fashion Maker Still Makes Sense

To be fair, there are scenarios where a general accessory maker is a practical choice:

- Extremely low-budget, one-off campaigns

- Short-term bundle gifts where the bag isn’t expected to last

- Projects where the bag is just a visual prop, not a daily-use item

If the target is simply “something cute to go with a limited promotion,” a basic pouch can do the job.

But as soon as:

the bag carries your logo,

customers post it on social media,

or it gets used as a daily organiser in handbags and suitcases,

weak materials and rushed construction start to hurt the brand more than they help.

How Topfeel Positions Itself for Long-Term Use

Topfeel’s strength is in serving beauty brands that view cosmetic bags as part of their product ecosystem, not just packaging.

Typical advantages clients notice after switching from generic suppliers include:

- Fewer complaints about zippers and seams

- Better-looking bags after months of use, which keeps the logo in circulation longer

More flexibility in matching bag design to different product lines: minimalist skincare, colorful makeup, eco collections, travel-focused ranges

Because the company already has patterns and experience across cosmetic cases, toiletry bags, drawstring bags, clutches, travel bags and more, it can adapt proven structures instead of experimenting blindly on a live project. That reduces risk for buyers who need bags to perform reliably across multiple markets.

What This Means for Buyers in Practical Terms

If you’re choosing between a fast-fashion accessory maker and a beauty-focused supplier like Topfeel, the real question is:

“Do I want this bag to survive a season, or to follow the customer wherever their routine goes?”

For short-lived freebies, a basic pouch may still make sense.

For core collections, gift-with-purchase programs, subscription boxes, and branded accessories that should build loyalty, a specialist partner will almost always deliver better value over time.

You pay not just for material and sewing, but for:

- Thought-out layouts

- Better internal finishing

And a manufacturing mindset built around beauty routines, not just fashion trends.

In that space, Topfeel’s combination of material range, attention to construction, and focus on cosmetic bags is exactly what sets it apart from typical fast-fashion accessory makers.