What Is the Profit Margin on Handbags?

When it comes to chasing “handbag profit,” we’re not talking about pocket change—we’re talking big-time margins that can put a sparkle in your quarterly report. In an industry where style meets strategy, the right cosmetic bag can pull double duty: looking sharp while padding your bottom line.

Think of it like this—choosing smart materials and slick features is kinda like picking toppings at a froyo bar: skip the fluff, go for what adds value (and taste). A canvas tote with reinforced seams? That’s not just sturdy—it screams quality without blowing your budget sky-high.

According to McKinsey & Company’s Fashion Industry Report, accessories like handbags often outperform apparel in markup potential—driving gross margins north of 60%.

You want bags that sell themselves and still leave room for dessert on your profit sheet. So let’s roll up our sleeves and unpack what makes these carryalls cash cows.

Key Points to Power Up Handbag Profit Potential

➔ Material Matters: Premium vegan leather drives luxury margins, while canvas and recyclable polyester trim costs without losing appeal.

➔ Big Bags, Bigger Profits: Extra-large capacity designs and spacious compartments justify higher price points through added functionality.

➔ Features That Sell: Interior pockets, reinforced stitching, and adjustable straps increase perceived quality—and your profit margin.

➔ Customization Pays Off: Personalized logos, bespoke patterns, and Pantone color matching add exclusivity that commands a premium.

➔ Bulk Smarts for Better Margins: Bulk sourcing of cotton twill and simplified construction techniques help reduce labor costs in large orders.

➔ Luxury Leverage: Limited editions with rare color palettes drive demand through scarcity—perfect for boosting handbag profit in upscale markets.

Data Shows: Average Handbag Profit Margin Reaches 60%

The average handbag profit margin is skyrocketing, and it’s not just about price tags—it’s about smart choices in materials, size, and features.

Profit Margins by Material: premium vegan leather vs. durable canvas fabric

- Premium vegan leather bags typically command a higher retail price, thanks to their luxe look and feel.

- Canvas handbags cost less in material costs, but offer attractive markup potential due to lower manufacturing cost.

- Brands that balance both materials see stronger margins across product lines.

Canvas shines when you’re going mass-market; vegan leather dominates the boutique scene. Either way, the supply chain must stay tight to keep that margin sweet.

How Size Types Like extra-large capacity design affect markups

- Larger bags mean more raw material—so yes, your labor costs go up slightly, but…

- Shoppers love the idea of more space—especially with travel or work totes—so you can charge more without blinking.

- Bigger bags often signal better value-per-dollar in shoppers’ minds, which boosts both appeal and perceived quality.

That combo? A win-win that nudges your pricing strategy into higher territory while keeping your audience hooked.

Role of features such as multiple interior pockets in boosting profit

• More pockets = more function = more reasons to buy

• Customers crave organization—it turns a simple bag into a daily essential

• Adding these features doesn’t spike your operating expenses, but lets you nudge prices upward

It’s low-cost enhancement with high-margin payoff—exactly what savvy handbag brands aim for when maximizing their sales volume without losing style points.

Custom Pantone color matching and personalized logo imprinting premiums

Custom touches like exact Pantone shades or branded logos add exclusivity—and exclusivity sells at a premium.

Customers are willing to pay extra when their bag feels tailor-made or brand-aligned, especially in corporate gifting or influencer merch runs. These upgrades barely move the needle on manufacturing cost, yet they push the final retail price significantly higher.

One brand doing this right? Topfeel—with sleek personalization options that make every unit feel like a limited edition drop while locking down solid margins on every sale.

In short: custom equals cash flow when done smartly in today’s competitive handbag game.

4 Cost-Saving Strategies For Higher Handbag Profit

Cutting costs without cutting corners is the name of the game when you’re chasing better handbag profit margins.

Material optimization with recyclable polyester material cuts costs

• Swapping traditional fabrics for recyclable polyester trims down raw expenses and gives your brand a green badge.

• This shift isn’t just about cost—it also appeals to eco-conscious buyers, which can boost volume sales over time.

• Lightweight, durable, and available in bulk, it’s a win-win for both your wallet and the planet.

By focusing on smarter material sourcing, brands can reduce waste while increasing profit per unit—especially when sustainable materials like recycled polyester become part of the production pipeline.

Bulk sourcing of heavy-duty cotton twill for economies of scale

Grouped benefits from bulk buying make this strategy a go-to move:

- Cost Efficiency: Buying in large quantities slashes per-yard prices.

- Inventory Stability: Keeps production moving without delays.

- Supplier Loyalty Perks: Long-term orders often unlock discounts or priority service.

Heavy-duty cotton twill isn’t just rugged—it’s also versatile, which minimizes design limitations while maximizing return on investment through smart inventory management and consistent supply chains.

Simplified constructions using removable divider inserts to reduce labor

Shorter stitching time equals lower labor costs—simple math that works wonders.

Divider inserts that snap or slide into place eliminate complex inner compartments, making assembly faster than ever. With fewer seams and less sewing required, workers can complete more units per hour without compromising quality. This approach not only boosts your overall production efficiency but also reduces errors during manufacturing—a small tweak with big implications for long-term production efficiency gains.

According to McKinsey’s 2024 Apparel Operations Report, “brands that simplify internal bag architecture see up to a 22% drop in direct labor hours within six months.”

Negotiating sample product requests and flexible payment terms

Let’s break down why smart negotiation with suppliers is such a clutch move:

■ Sample Requests – Get test runs before committing to mass production; it saves you from costly mistakes later.

■ Payment Flexibility – Net terms like 30/60/90 days give breathing room so cash flow doesn’t choke under pressure.

Both tactics ease upfront financial strain while enhancing trust between buyer and supplier—leading to smoother deals down the line. Strong relationships built through savvy supplier negotiation can even open doors for reduced shipping rates or exclusive material access, all feeding into healthier margins on every handbag sold.

By tweaking how you handle supplier agreements and prototypes early on, you’re setting yourself up for stronger long-term control over both spending and final product quality—all vital levers for lifting overall handbag profit levels.

Why Are Luxury Bags So Profitable?

Luxury handbags aren’t just fashion statements—they’re money-making machines. Let’s unpack what makes them such goldmines.

Premium vegan leather and reinforced stitching command higher prices

- High-grade vegan leather mimics the texture and durability of animal hide, but it’s cruelty-free and trendy.

- Reinforced stitching isn’t just about strength—it signals craftsmanship, which buyers are willing to pay extra for.

- These materials don’t come cheap, but the markup is massive. That margin? It fuels luxury high profit margins like clockwork.

- When you touch a bag that feels sturdy and smooth, your brain registers “worth it.” That’s no accident; it’s engineered value.

Bespoke pattern creations and unique design embellishments drive value

- Custom patterns turn each bag into a wearable piece of art—no two collections feel the same.

- Embellishments like hand-painted motifs or rare metal accents scream exclusivity.

- Designers use these touches to create emotional connections—people aren’t just buying bags, they’re buying stories.

This is where brand prestige gets built from the ground up. A unique look becomes iconic, then iconic becomes collectible—and that’s when the real handbag profit kicks in.

Personalized logo imprinting and custom label placements elevate exclusivity

• A monogrammed logo on buttery-soft material? Instant personalization.

• Hidden labels with initials stitched inside? Adds intimacy to ownership.

• These branding tweaks tap into our craving for uniqueness—and help brands justify sky-high prices.

According to Bain & Company’s Spring-Summer Luxury Report 2024, “Personalized luxury goods saw a year-over-year growth rate of over 18%, outpacing standard collections.”

Limited editions featuring personalized color palettes enhance rarity

Short-run drops with custom hues do more than add variety—they manufacture desire through scarcity. You snooze, you lose.

Each limited edition becomes an investment piece:

- Collectors chase them down because they know the supply is capped.

- The resale market thrives on this model—bags bought at $800 can flip for $2K+ within months if demand spikes.

- This artificial rarity fuels both hype and long-term investment potential, especially among Gen Z buyers who treat bags like stock portfolios.

For evidence, check the luxury resale market’s value-retention data—Rebag’s annual Clair Report tracks multi-brand resale values across seasons.

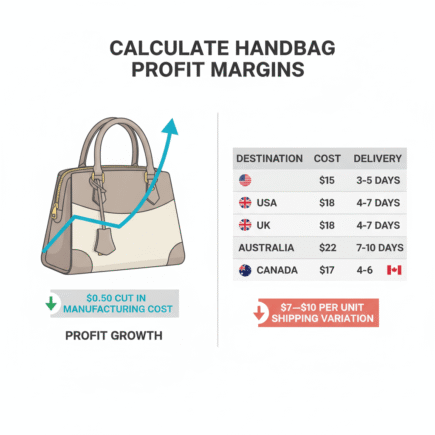

Wholesale Orders: Calculate Handbag Profit Margins

Understanding how to work out your handbag profit margins in wholesale is key to making smarter pricing decisions and scaling up fast.

Evaluating wholesale pricing options and bulk order discounts

• Buying in bulk slashes your per-unit wholesale price, which directly boosts your net profit on each bag sold.

• Brands often overlook that even a $0.50 cut in manufacturing cost can mean thousands saved over large orders.

• Always compare tiered supplier offers—some offer deeper discounts for orders over specific thresholds like 500 or 1000 units.

• Don’t forget seasonal promos; many manufacturers drop prices during off-seasons, ideal for stocking up early.

• Use tools or spreadsheets to track how each price break affects your overall profit margin percentage, especially when dealing with changing currencies or fluctuating material costs.

Factoring international shipping availability into margin calculations

- Start by calculating the full landed cost per item, including duties, VAT, and customs fees—those hidden extras eat into your bottom line fast.

- Then cross-check regional courier rates; shipping one handbag to Europe versus Asia can vary by as much as $7–$10 per unit.

- Factor in delays too—longer delivery times may increase refund risks or reduce perceived value, impacting resale potential.

- Some wholesalers offer consolidated freight options that dramatically lower per-unit shipping costs, especially above certain volumes.

- Always re-calculate your total cost of goods sold when expanding internationally—it’s never just about product cost alone!

| Destination | Avg Shipping Cost/Unit | Customs Fee | Delivery Time |

|---|---|---|---|

| USA | $4.20 | $0 | 5–7 days |

| UK | $6.75 | $2.10 | 6–9 days |

| Australia | $8.30 | $1.90 | 10–14 days |

| Canada | $5.95 | $1.50 | 7–11 days |

Accounting for custom label placements in large-volume orders

Short-run labels are cheap—but scale up, and they start chewing into profits if you don’t plan ahead:

• A custom woven label might only cost $0.15 at small volumes but drops to under $0.05 if you’re ordering over a thousand pieces at once.

• However, placement labor adds another layer—sewing inside linings vs exterior tags changes the game entirely on labor time and complexity.

• For brands like Topfeel offering private-label services, it’s crucial you bake these micro-costs into the final pricing formula so it doesn’t sneak up later and kill your margins.

Watch how these tweaks affect your numbers:

→ Label design setup fee = fixed across runs ($80 avg)

→ Per-bag sewing time = variable labor rate x minutes/bag

→ Material waste = minor but cumulative with hand-cut labels

These details matter more than you’d think when you’re chasing consistent high-volume handbag profit streams across multiple regions!

Integrating customization costs like adjustable shoulder straps into profits

Adjustable straps seem minor but make a big dent—or boost—in your margin math depending on how you play it:

▪️ Added hardware like sliders or buckles raises the base variable costs, especially with metal finishes or branded embossing involved.

▪️ Customers love functionality though—so adding this feature lets you bump up the final retail price, often by at least $8–$12 without resistance.

▪️ The trick? Keep production efficient by using standardized strap lengths across styles so you don’t increase waste or complexity unnecessarily.

▪️ Always compare added value vs added cost: If it increases conversion rate by even a few percent, it’s usually worth it long term for better overall profit margin percentage returns across SKUs.

By smartly optimizing features like this while keeping an eye on both style and spend, you’ll keep those handbag profits flowing smoother than ever!

FAQs about Handbag Profit

How does handbag profit vary by material type?

The choice of material can completely shift the pricing game. Premium vegan leather, for instance, gives off a luxury vibe and lets you price higher without much customer resistance. Canvas feels more casual but keeps costs low—great for everyday bags with solid margins. Recyclable polyester isn’t just eco-friendly; it’s also wallet-friendly on the production side. And cotton twill? It’s sturdy, classic, and shines in bulk orders.

What features help boost handbag profit the most?

- Interior pockets add function—and customers love function.

- Reinforced stitching makes a bag feel built to last.

- Thoughtful construction leads to fewer returns and better reviews.When buyers see these details, they’re willing to pay more because it feels like someone actually cared while making it.

Can custom color options increase my handbag profit margin?

Absolutely—but not just any colors. When you offer shades that align with your brand or match seasonal trends exactly (think Pantone-perfect), you’re not just selling a product—you’re offering identity. Limited runs in rare hues create urgency too: “Get this coral blush before it’s gone.” That kind of emotional trigger drives up perceived value fast.

Why do extra-large capacity designs have better markup potential?

It’s simple psychology—bigger often feels like better value. A roomy tote suggests versatility: gym bag today, weekender tomorrow, diaper bag next month… all rolled into one purchase. Sure, materials cost slightly more upfront (especially if you line them with waterproof nylon), but customers are happy to pay extra when they believe they’re getting multi-use functionality from a single item.

Which customization types appeal most to wholesale buyers of cosmetic bags?

- Logo imprinting helps their brand travel far and wide.

- Unique patterns make resale easier—they stand out on shelves.

- Custom labels give even budget items a high-end finish.Wholesale clients are thinking resale or gifting potential; anything that adds polish without complicating logistics is gold.

References

- The State of Fashion 2024 — McKinsey & BoF — https://www.mckinsey.com/industries/retail/our-insights/state-of-fashion-2024

- LVMH Gross Profit Margin (multi-year) — Finbox — https://finbox.com/LVMUY/explorer/gp_margin/

- Hermès 2023 Full-Year Results (Press Release) — https://assets-finance.hermes.com/s3fs-public/node/pdf_file/2024-02/1707422069/hermes_20240209_pr_2023fullyearresults_va.pdf

- Luxury Report 2024: Rebuilding the Foundations of Luxury — Bain & Company — https://www.bain.com/insights/luxury-in-transition-securing-future-growth/

- Reimagining the apparel value chain amid volatility — McKinsey — https://www.mckinsey.com/industries/retail/our-insights/reimagining-the-apparel-value-chain-amid-volatility

- Clair Report 2024 — Rebag — https://www.rebag.com/clair-report/2024/

- What Is Landed Cost? — Shopify — https://www.shopify.com/uk/blog/landed-cost

- Duty, Taxes and other Fees required to import goods into the United States — U.S. CBP — https://www.help.cbp.gov/s/article/Article-1225

- The State of Luxury 2025 — McKinsey — https://www.mckinsey.com/industries/retail/our-insights/state-of-luxury

- The value of getting personalization right — McKinsey — https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/the-value-of-getting-personalization-right-or-wrong-is-multiplying