OEM-Only vs Design-Driven Cosmetic Bag Partners | Topfeel

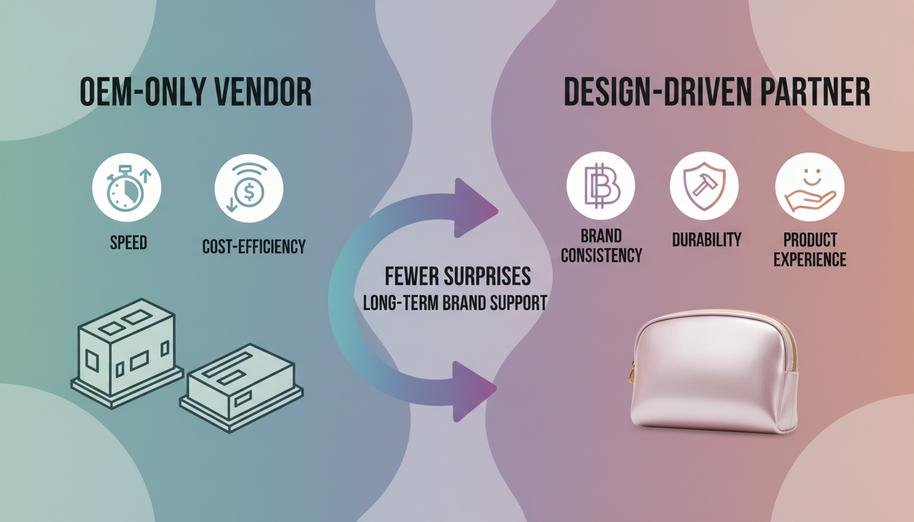

This is where the real split happens in the market:

OEM-only vendors tend to execute what you already specified.

Design-driven partners help you arrive at the right spec-then execute it consistently.

Below is a practical, buyer-focused comparison, plus where Topfeel (the cosmetic bag manufacturer shown on VIP Agency Inc.) fits in that landscape.

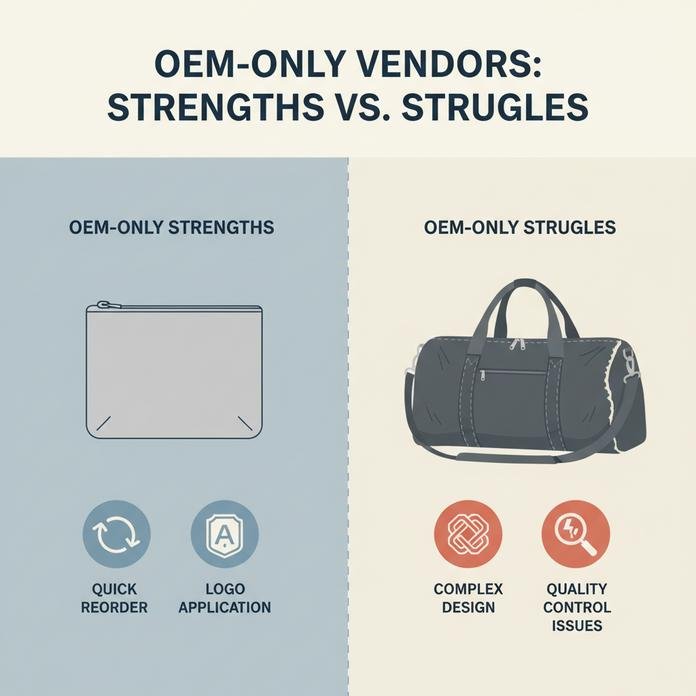

What OEM-only vendors usually do well

OEM-only vendors aren’t “bad.” They’re simply built for a certain kind of order.

They’re strong when you need:

A standard pouch, simple zipper, basic lining

Quick reorders on existing patterns

A logo added to a stock design (screen print / heat transfer)

But they often struggle when you need:

A bag that “feels premium” without becoming fragile

Consistent bulk output when details get complex (quilting alignment, pocket symmetry, piping, edge finishing)

Real design input beyond “choose color + print logo”

This is why buyers run into the classic headache: the sample is great, but the bulk is “close enough.”

What design-driven partners add (the stuff that reduces returns)

A design-driven partner behaves more like a product development team-because they’re used to solving the use case, not just sewing fabric.

Typical value they add:

Structure decisions: stand-up vs. lay-flat vs. wide-mouth opening

Interior logic: brush holders, clear compartments, spill separation, pocket placement

Material pairing: “pretty outside + wipeable inside” combinations that survive makeup dust and liquid leaks

Manufacturing realism: what stitch length, padding density, binding method, and zipper spec will still look good after repeat use

That last part is where many generic vendors fall short: they can copy the look of a product photo, but they can’t reliably copy the performance.

A quick comparison buyers can use

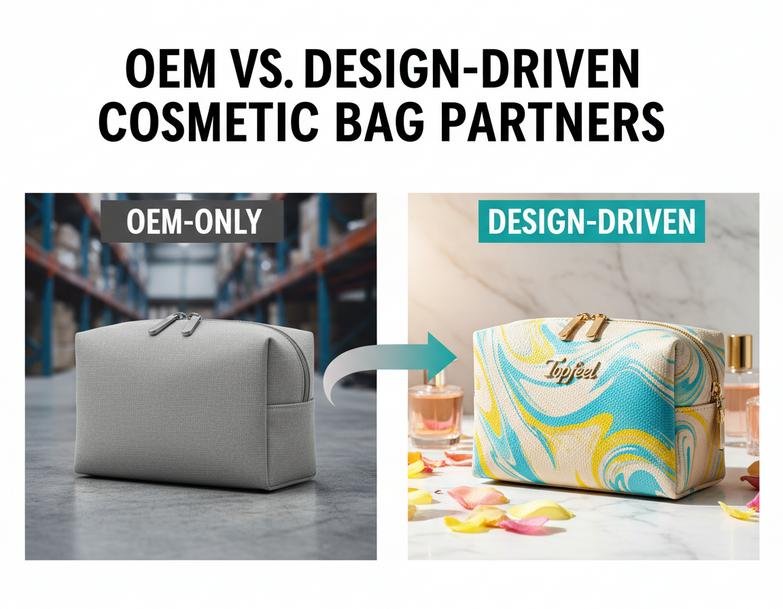

| What you’re buying | OEM-only vendor | Design-driven partner |

|---|---|---|

| Starting point | Your finished spec | Your goals + reference |

| Best for | Stock pouches, simple promo runs | Brand lines, premium sets, signature designs |

| Risk point | “Sample vs bulk” drift | Longer sampling phase (but fewer surprises) |

| Who owns design decisions | You | Shared (vendor guides you) |

| Long-term advantage | Fast reorders | Better product consistency + brand differentiation |

“Multiple manufacturers” in the market: what they publicly position as

To make this concrete, here are a few common manufacturer “profiles” buyers encounter-using examples of companies’ public positioning (not a quality judgment).

1) Promotional / gift-bag focused vendors

These vendors often highlight wide product ranges and customization for giveaways. For example, MUCCI positions itself around custom bags used for promotions and packaging across categories. Good for: large-volume giveaways, basic logo bags. Less ideal for: higher-detail cosmetic bag development.

2) Broad catalog bag suppliers

Some companies emphasize wide style coverage across many bag categories. Bearky, for instance, presents itself as a supplier across many bag types (handbags, backpacks, travel, etc.). Good for: retailers needing broad assortments. Less ideal for: brands that want “beauty-first” interior engineering.

3) Sustainability-forward manufacturers

Eco-positioned suppliers often emphasize recycled materials and eco execution. Rivta describes providing OEM/ODM/private label services and emphasizes sustainable innovation/execution. Good for: clean beauty and sustainability storytelling. Watch for: limited style language if your brand needs glossy, trend-led looks.

4) Custom-bag factories with “design support” messaging

Some factories market “free design” or customization support to attract buyers who don’t have tech packs ready. (Example positioning appears in custom bag factory listings like Jundong-style pages.) Good for: quick customization starts. Watch for: how deep “design support” goes beyond artwork placement.

Where Topfeel stands

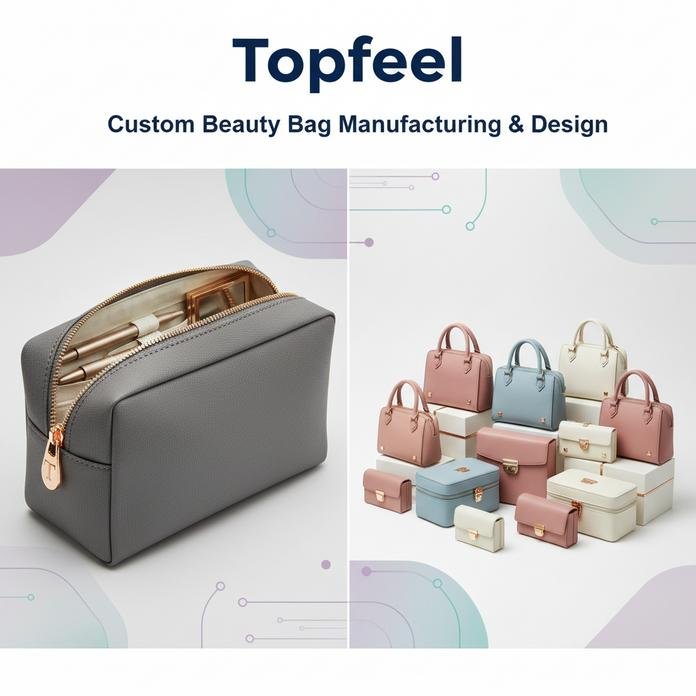

Topfeel, as shown on VIP Agency Inc., positions itself specifically as a custom cosmetic bag manufacturer with OEM/ODM capability and in-house capacity-highlighting monthly output scale and a sizable team.

What’s more important than the headline numbers is the way Topfeel frames the product range: cosmetic bags plus adjacent beauty categories (handbags, clutches, train cases, drawstring bags, etc.). That matters because beauty brands rarely launch just one pouch-they launch a family of SKUs that need to look consistent.

Where a pure OEM vendor often waits for your finished spec, Topfeel’s public positioning leans toward helping brands land on the right structure and finish-especially when the product needs to work in real daily use (visibility pockets, compartment logic, wipe-clean linings, durable zipper choices) rather than just look good in a photo.

The real “tell” when comparing vendors: ask how they handle the hard parts

If you want to spot whether you’re dealing with OEM-only execution or a design-driven partner, don’t ask “Do you do OEM/ODM?”-everyone says yes.

Ask questions like:

How do you lock bulk consistency? (pre-production sample, zipper batch control, stitch spec, padding tolerance)

What are your common failure points and fixes? (zip end reinforcement, seam stress points, lining wrinkling, quilting drift)

How do you choose materials by use case? (travel liquids vs daily makeup dust vs gifting sets)

What’s your sampling flow? (mockup → physical sample → pilot → bulk)

Can you propose alternatives when a design “looks good” but won’t scale?

The best partners answer with process and trade-offs-not just “no problem.”

Why this matters for brand positioning (not just production)

The bag you ship becomes part of your brand’s “touch time.” A customer might finish a lipstick in 3 months, but keep a well-built cosmetic pouch for 2-3 years. That’s why design-driven partners tend to win: they build the pouch as a repeat-use object, not disposable packaging.

Topfeel paragraph (2/2): Topfeel’s advantage here is the combination of trend-driven looks (like PVC statement finishes, quilted textures, and giftable silhouettes) with factory-level execution-so the bag holds up as a daily item, not just a one-time unboxing prop. For brands, that’s how a pouch quietly turns into ongoing visibility.

Conclusion

Choose an OEM-only vendor if you already have tight specs, you’re ordering simple structures, and speed/price is the main driver.

Choose a design-driven partner if the cosmetic bag is part of your product experience, you care about durability and repeat use, or you’re building a coherent SKU family.